Advertisement

-

Published Date

May 20, 2024This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

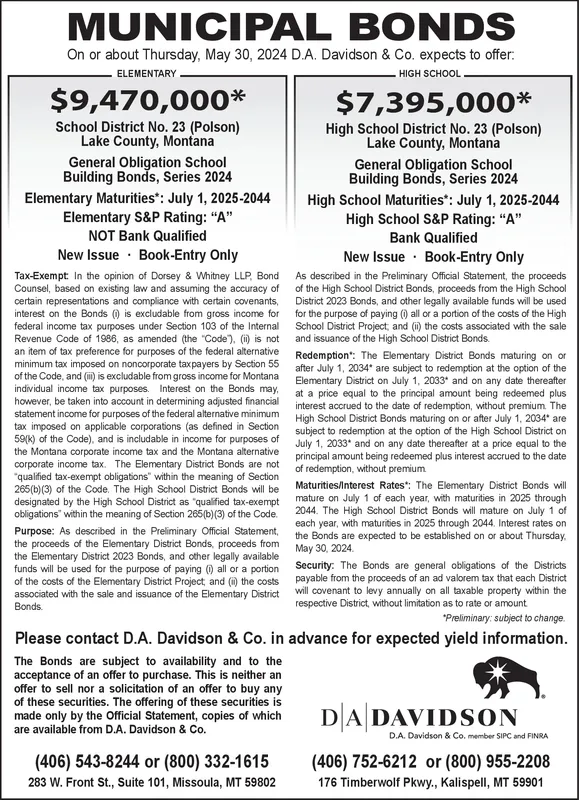

MUNICIPAL BONDS On or about Thursday, May 30, 2024 D.A. Davidson & Co. expects to offer: ELEMENTARY $9,470,000* School District No. 23 (Polson) Lake County, Montana General Obligation School Building Bonds, Series 2024 Elementary Maturities*: July 1, 2025-2044 Elementary S&P Rating: "A" NOT Bank Qualified New Issue Book-Entry Only Tax-Exempt: In the opinion of Dorsey & Whitney LLP, Bond Counsel, based on existing law and assuming the accuracy of certain representations and compliance with certain covenants, interest on the Bonds () is excludable from gross income for federal income tax purposes under Section 103 of the Internal Revenue Code of 1986, as amended (the "Code"), (ii) is not an item of tax preference for purposes of the federal alternative minimum tax imposed on noncorporate taxpayers by Section 55 of the Code, and (iii) is excludable from gross income for Montana individual income tax purposes. Interest on the Bonds may, however, be taken into account in determining adjusted financial statement income for purposes of the federal alternative minimum tax imposed on applicable corporations (as defined in Section 59(k) of the Code), and is includable in income for purposes of the Montana corporate income tax and the Montana alternative corporate income tax. The Elementary District Bonds are not "qualified tax-exempt obligations" within the meaning of Section 265(b)(3) of the Code. The High School District Bonds will be designated by the High School District as "qualified tax-exempt obligations" within the meaning of Section 265(b)(3) of the Code. Purpose: As described in the Preliminary Official Statement, the proceeds of the Elementary District Bonds, proceeds from the Elementary District 2023 Bonds, and other legally available funds will be used for the purpose of paying (1) all or a portion of the costs of the Elementary District Project, and (ii) the costs associated with the sale and issuance of the Elementary District Bonds. HIGH SCHOOL $7,395,000* High School District No. 23 (Polson) Lake County, Montana General Obligation School Building Bonds, Series 2024 High School Maturities*: July 1, 2025-2044 High School S&P Rating: "A" Bank Qualified New Issue Book-Entry Only As described in the Preliminary Official Statement, the proceeds of the High School District Bonds, proceeds from the High School District 2023 Bonds, and other legally available funds will be used for the purpose of paying () all or a portion of the costs of the High School District Project, and (ii) the costs associated with the sale and issuance of the High School District Bonds. Redemption: The Elementary District Bonds maturing on or after July 1, 2034* are subject to redemption at the option of the Elementary District on July 1, 2033* and on any date thereafter at a price equal to the principal amount being redeemed plus interest accrued to the date of redemption, without premium. The High School District Bonds maturing on or after July 1, 2034* are subject to redemption at the option of the High School District on July 1, 2033* and on any date thereafter at a price equal to the principal amount being redeemed plus interest accrued to the date of redemption, without premium Maturities/Interest Rates: The Elementary District Bonds will mature on July 1 of each year, with maturities in 2025 through 2044. The High School District Bonds will mature on July 1 of each year, with maturities in 2025 through 2044. Interest rates on the Bonds are expected to be established on or about Thursday, May 30, 2024. Security: The Bonds are general obligations of the Districts payable from the proceeds of an ad valorem tax that each District will covenant to levy annually on all taxable property within the respective District, without limitation as to rate or amount *Preliminary: subject to change. Please contact D.A. Davidson & Co. in advance for expected yield information. The Bonds are subject to availability and to the acceptance of an offer to purchase. This is neither an offer to sell nor a solicitation of an offer to buy any of these securities. The offering of these securities is made only by the Official Statement, copies of which are available from D.A. Davidson & Co. (406) 543-8244 or (800) 332-1615 283 W. Front St., Suite 101, Missoula, MT 59802 DA DAVIDSON D.A. Davidson & Co. member SIPC and FINRA (406) 752-6212 or (800) 955-2208 176 Timberwolf Pkwy., Kalispell, MT 59901 MUNICIPAL BONDS On or about Thursday , May 30 , 2024 D.A. Davidson & Co. expects to offer : ELEMENTARY $ 9,470,000 * School District No. 23 ( Polson ) Lake County , Montana General Obligation School Building Bonds , Series 2024 Elementary Maturities * : July 1 , 2025-2044 Elementary S & P Rating : " A " NOT Bank Qualified New Issue Book - Entry Only Tax - Exempt : In the opinion of Dorsey & Whitney LLP , Bond Counsel , based on existing law and assuming the accuracy of certain representations and compliance with certain covenants , interest on the Bonds ( ) is excludable from gross income for federal income tax purposes under Section 103 of the Internal Revenue Code of 1986 , as amended ( the " Code " ) , ( ii ) is not an item of tax preference for purposes of the federal alternative minimum tax imposed on noncorporate taxpayers by Section 55 of the Code , and ( iii ) is excludable from gross income for Montana individual income tax purposes . Interest on the Bonds may , however , be taken into account in determining adjusted financial statement income for purposes of the federal alternative minimum tax imposed on applicable corporations ( as defined in Section 59 ( k ) of the Code ) , and is includable in income for purposes of the Montana corporate income tax and the Montana alternative corporate income tax . The Elementary District Bonds are not " qualified tax - exempt obligations " within the meaning of Section 265 ( b ) ( 3 ) of the Code . The High School District Bonds will be designated by the High School District as " qualified tax - exempt obligations " within the meaning of Section 265 ( b ) ( 3 ) of the Code . Purpose : As described in the Preliminary Official Statement , the proceeds of the Elementary District Bonds , proceeds from the Elementary District 2023 Bonds , and other legally available funds will be used for the purpose of paying ( 1 ) all or a portion of the costs of the Elementary District Project , and ( ii ) the costs associated with the sale and issuance of the Elementary District Bonds . HIGH SCHOOL $ 7,395,000 * High School District No. 23 ( Polson ) Lake County , Montana General Obligation School Building Bonds , Series 2024 High School Maturities * : July 1 , 2025-2044 High School S & P Rating : " A " Bank Qualified New Issue Book - Entry Only As described in the Preliminary Official Statement , the proceeds of the High School District Bonds , proceeds from the High School District 2023 Bonds , and other legally available funds will be used for the purpose of paying ( ) all or a portion of the costs of the High School District Project , and ( ii ) the costs associated with the sale and issuance of the High School District Bonds . Redemption : The Elementary District Bonds maturing on or after July 1 , 2034 * are subject to redemption at the option of the Elementary District on July 1 , 2033 * and on any date thereafter at a price equal to the principal amount being redeemed plus interest accrued to the date of redemption , without premium . The High School District Bonds maturing on or after July 1 , 2034 * are subject to redemption at the option of the High School District on July 1 , 2033 * and on any date thereafter at a price equal to the principal amount being redeemed plus interest accrued to the date of redemption , without premium Maturities / Interest Rates : The Elementary District Bonds will mature on July 1 of each year , with maturities in 2025 through 2044. The High School District Bonds will mature on July 1 of each year , with maturities in 2025 through 2044. Interest rates on the Bonds are expected to be established on or about Thursday , May 30 , 2024 . Security : The Bonds are general obligations of the Districts payable from the proceeds of an ad valorem tax that each District will covenant to levy annually on all taxable property within the respective District , without limitation as to rate or amount * Preliminary : subject to change . Please contact D.A. Davidson & Co. in advance for expected yield information . The Bonds are subject to availability and to the acceptance of an offer to purchase . This is neither an offer to sell nor a solicitation of an offer to buy any of these securities . The offering of these securities is made only by the Official Statement , copies of which are available from D.A. Davidson & Co. ( 406 ) 543-8244 or ( 800 ) 332-1615 283 W. Front St. , Suite 101 , Missoula , MT 59802 DA DAVIDSON D.A. Davidson & Co. member SIPC and FINRA ( 406 ) 752-6212 or ( 800 ) 955-2208 176 Timberwolf Pkwy . , Kalispell , MT 59901