Advertisement

-

Published Date

February 1, 2026This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

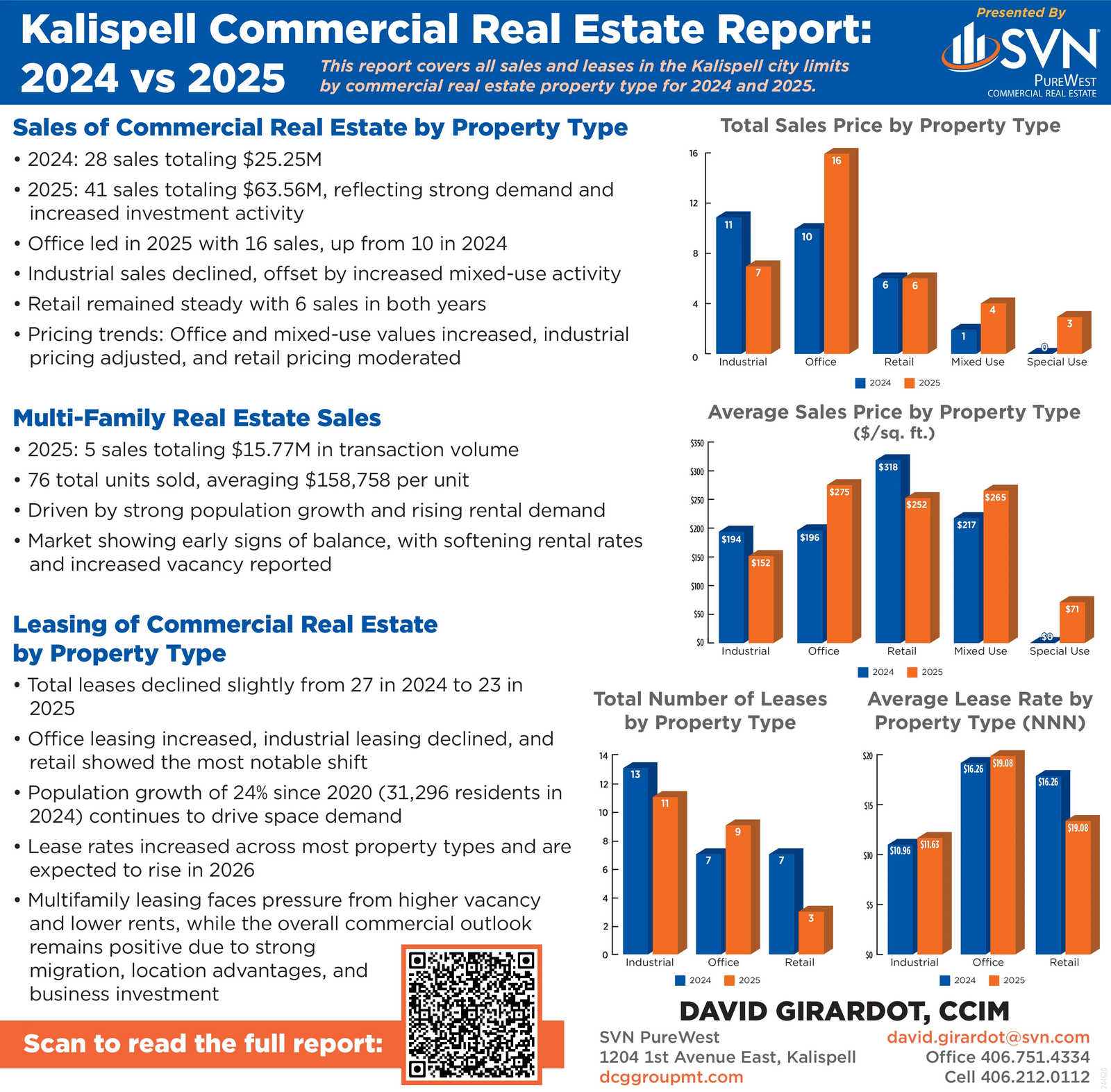

Kalispell Commercial Real Estate Report: 2024 vs 2025 This report covers all sales and leases in the Kalispell city limits by commercial real estate property type for 2024 and 2025. Sales of Commercial Real Estate by Property Type 2024: 28 sales totaling $25.25M 2025: 41 sales totaling $63.56M, reflecting strong demand and increased investment activity 16 Presented By ab SVN PURE WEST COMMERCIAL REAL ESTATE Total Sales Price by Property Type 12 11 10 16 Office led in 2025 with 16 sales, up from 10 in 2024 Industrial sales declined, offset by increased mixed-use activity Retail remained steady with 6 sales in both years Pricing trends: Office and mixed-use values increased, industrial pricing adjusted, and retail pricing moderated Multi-Family Real Estate Sales . 2025: 5 sales totaling $15.77M in transaction volume 8 6 6 4 0 Industrial Office Retail Mixed Use Special Use 2024 2025 $350 Average Sales Price by Property Type ($/sq. ft.) 76 total units sold, averaging $158,758 per unit Driven by strong population growth and rising rental demand Market showing early signs of balance, with softening rental rates and increased vacancy reported Leasing of Commercial Real Estate by Property Type Total leases declined slightly from 27 in 2024 to 23 in 2025 Office leasing increased, industrial leasing declined, and retail showed the most notable shift Population growth of 24% since 2020 (31,296 residents in 2024) continues to drive space demand Lease rates increased across most property types and are expected to rise in 2026 $300 $250 $200 $194 $196 $150 $152 $100 $318 $275 $252 $217 $265 $50 $71 $0 Industrial Office Retail Mixed Use Special Use 2024 2025 Average Lease Rate by Total Number of Leases by Property Type 14 13 12 11 10 8 7 6 9 7 Property Type (NNN) $20- $15 $10 $10.96 $11.63 $19.08 $16.26 $16.26 $19.08 Multifamily leasing faces pressure from higher vacancy and lower rents, while the overall commercial outlook remains positive due to strong migration, location advantages, and business investment 4 $5 2 0 SO Industrial Office Retail Industrial Office Retail 2024 2025 2024 2025 Scan to read the full report: DAVID GIRARDOT, CCIM SVN Pure West 1204 1st Avenue East, Kalispell dcggroupmt.com david.girardot@svn.com Office 406.751.4334 Cell 406.212.0112 Kalispell Commercial Real Estate Report : 2024 vs 2025 This report covers all sales and leases in the Kalispell city limits by commercial real estate property type for 2024 and 2025 . Sales of Commercial Real Estate by Property Type 2024 : 28 sales totaling $ 25.25M 2025 : 41 sales totaling $ 63.56M , reflecting strong demand and increased investment activity 16 Presented By ab SVN PURE WEST COMMERCIAL REAL ESTATE Total Sales Price by Property Type 12 11 10 16 Office led in 2025 with 16 sales , up from 10 in 2024 Industrial sales declined , offset by increased mixed - use activity Retail remained steady with 6 sales in both years Pricing trends : Office and mixed - use values increased , industrial pricing adjusted , and retail pricing moderated Multi - Family Real Estate Sales . 2025 : 5 sales totaling $ 15.77M in transaction volume 8 6 6 4 0 Industrial Office Retail Mixed Use Special Use 2024 2025 $ 350 Average Sales Price by Property Type ( $ / sq . ft . ) 76 total units sold , averaging $ 158,758 per unit Driven by strong population growth and rising rental demand Market showing early signs of balance , with softening rental rates and increased vacancy reported Leasing of Commercial Real Estate by Property Type Total leases declined slightly from 27 in 2024 to 23 in 2025 Office leasing increased , industrial leasing declined , and retail showed the most notable shift Population growth of 24 % since 2020 ( 31,296 residents in 2024 ) continues to drive space demand Lease rates increased across most property types and are expected to rise in 2026 $ 300 $ 250 $ 200 $ 194 $ 196 $ 150 $ 152 $ 100 $ 318 $ 275 $ 252 $ 217 $ 265 $ 50 $ 71 $ 0 Industrial Office Retail Mixed Use Special Use 2024 2025 Average Lease Rate by Total Number of Leases by Property Type 14 13 12 11 10 8 7 6 9 7 Property Type ( NNN ) $ 20- $ 15 $ 10 $ 10.96 $ 11.63 $ 19.08 $ 16.26 $ 16.26 $ 19.08 Multifamily leasing faces pressure from higher vacancy and lower rents , while the overall commercial outlook remains positive due to strong migration , location advantages , and business investment 4 $ 5 2 0 SO Industrial Office Retail Industrial Office Retail 2024 2025 2024 2025 Scan to read the full report : DAVID GIRARDOT , CCIM SVN Pure West 1204 1st Avenue East , Kalispell dcggroupmt.com david.girardot@svn.com Office 406.751.4334 Cell 406.212.0112